January 23, 2026

Stearns Weaver Miller News Update

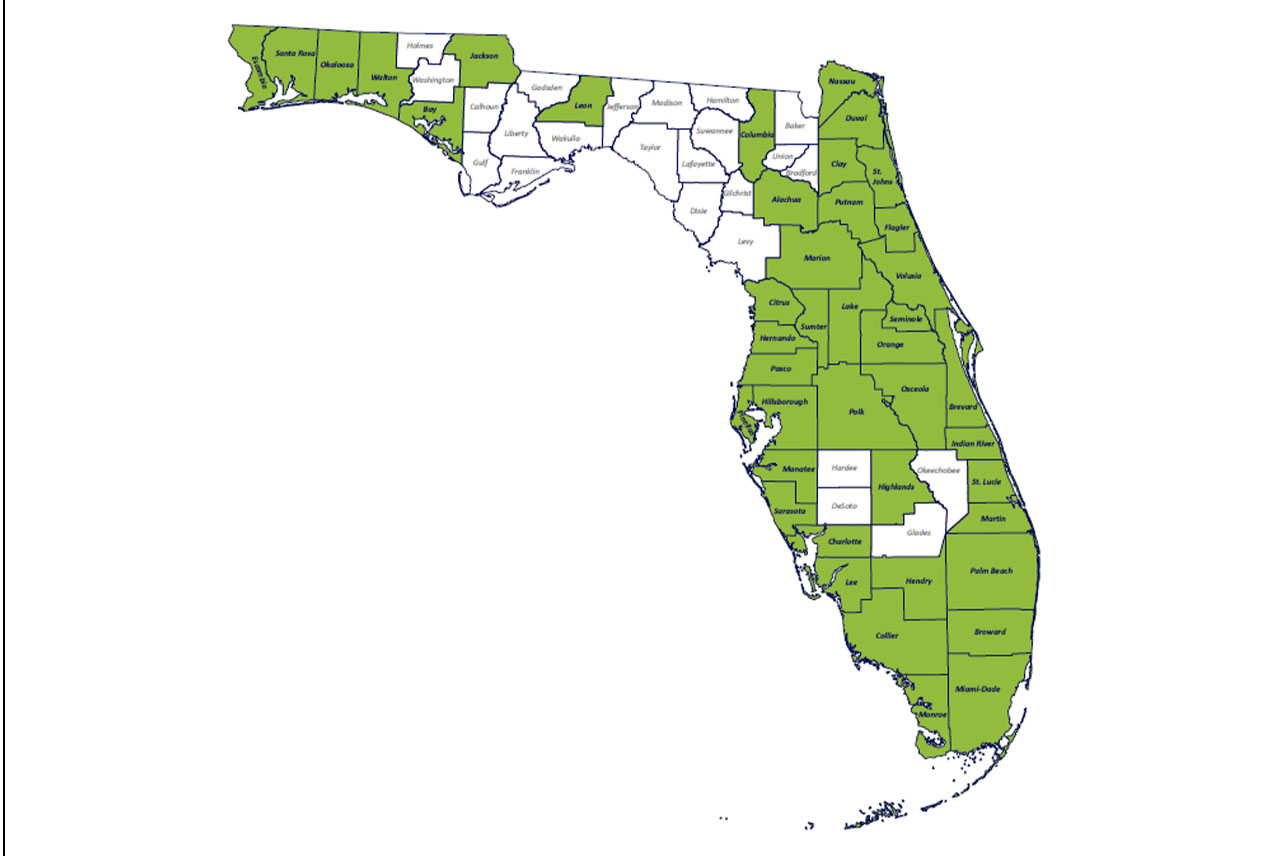

Our statewide group has decades of experience in almost every aspect of property tax law and appeals. We represent owners, tenants, managers, lenders and developers and have substantial experience challenging the valuation of a broad range of property types.